geothermal tax credit iowa

Web The Geothermal Heat Pump Tax Credit was previously available for installations beginning on or after January 1 2012 through December 31 2016. The Credit was available during calendar years CY 2017 and CY 2018 and was repealed January 1 2019.

Web November 19 2020 Tax Credit.

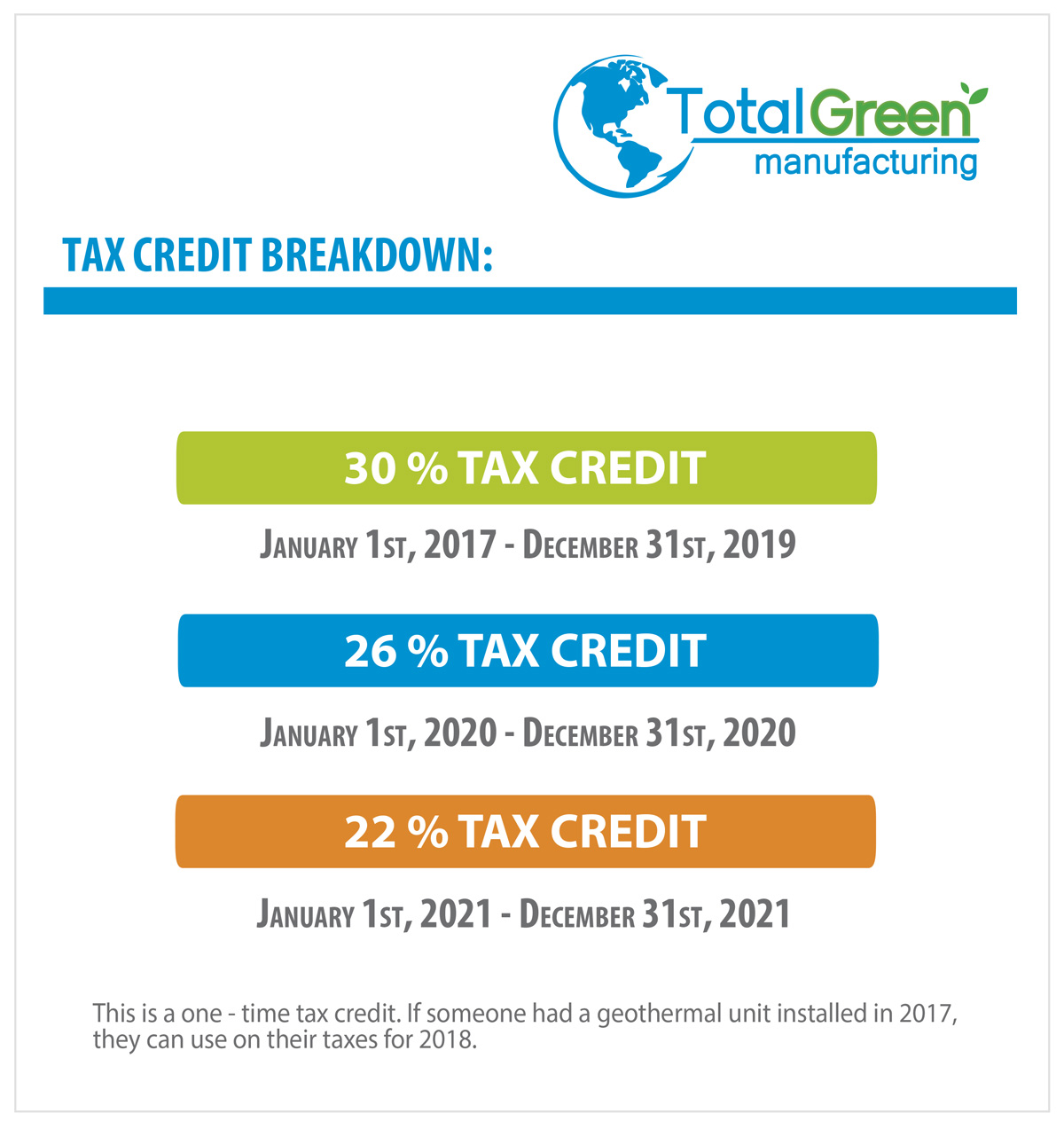

. The federal residential credit and thus the Iowa residential credit is. This number will carry through until the end of 2022 and drops to 22 in 2023. Effective Date _____ January 1 2017 The credit is applicable to qualified expenditures incurred on or after January 1 2017.

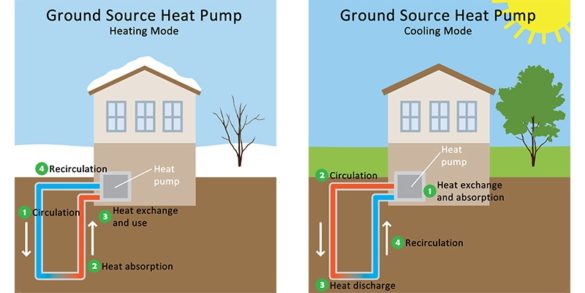

Web 2017 IA 140 Iowa Geothermal Tax Credit Instructions The Iowa Geothermal Tax Credit equals 10 of taxpayers qualified expenditures on equipment that uses the ground or groundwater as a thermal energy source to heat the taxpayers residence or as a thermal energy sink to cool the residence. Web The Iowa Geothermal Tax Credit is effectively a 52 credit based on a formula of 20 of the federal residential energy-efficient property tax credit which is 26 for tax years 2020 through 2022. Web Answers provided by.

Geothermal Tax Credit The Geothermal Tax Credit equaled 100 of qualified residential geothermal system installation costs. 41-169b 071218 2018 IA 140 Iowa Geothermal Tax Credit Instructions. Ad Enter Your Zip Code - Get Qualified Instantly.

The Iowa tax credit for business installations cannot exceed 20000. Geothermal Heat Pump Tax Credit 2 wwwlegisiowagov Doc ID 1156247 Fiscal Year Tax Credit Redemptions Fiscal Year Tax Credit Redemptions FY 2006 0 FY 2016 1895682 FY 2007 0 FY 2017 2185938 FY 2008 0 FY 2018 502511 FY 2009 0 FY 2019 192831. Effectively a 52 percent credit based on a formula of 20 of the federal residential energy efficient property tax credit which is 26 for tax years 2020 through 2022.

Web The American Recovery and Reinvestment Act adopted in October 2008 allows for a 22 tax credit for costs associated with ENERGY STAR qualified geothermal heat pumps as noted in section 25D of the Internal Revenue Code. Geothermal Heat Pump Tax Credit Awarded by Year. Web The Iowa Geothermal Tax Credit is effectively a 52 credit based on a formula of 20 of the federal residential energy-efficient property tax credit which is 26 for tax years 2020 through 2022.

See Iowa Code section 42211N. Web As we mentioned before the geothermal tax credit goes through cycles of reinstatement expiration and renewal within the US. Of the Internal Revenue Code.

For geothermal heat pump units installed on or after January 1 2019. The credit was equal to 20 of the federal residential energy efficient property tax credit allowed for geothermal heat pumps provided in section 25D a 5 of the Internal Revenue Code. Enter Your Zip See If You Qualify.

This credit is equal to 200 of the federal residential energy efficient property tax credit allowed for geothermal thermal heat pumps. 1 2019 and is available for Iowa homeowners on Iowa residential properties. Web Ground Floor State Capitol Building Des Moines Iowa 50319 5152813566 Tax Credit.

The equipment must meet the federal energy star. Web November 9 2021 Tax Credit. Section 2 of 2016 Iowa Acts House File 2468 adds new Section 42210A Code 2016.

Check 2022 Top Rated Solar Incentives in Iowa. Web This rule making implements the Iowa geothermal heat pump income tax credit enacted in 2019 Iowa Acts House File 779 for geothermal heat pumps installed on residential property in Iowa on or after January 1 2019. Enter in column C of Part I on the IA 148 Tax Credits Schedule.

The 22 credit applies to geothermal equipment placed in service during 2022. The dwelling must be the taxpayers residence and be located in Iowa. The credit is available for units installed on or after Jan.

The credit became available on January 1 2009 and sunsets January 1 2021. Web Iowa Geothermal Tax Credit unused in tax year 2017. There is also a federal tax credit for as much as 30 percent of the installed costs.

In 2019 the tax credit was renewed at 30 of the total system cost which dropped to 26 in 2020. Geothermal Tax Credit 2 wwwlegisiowagov Doc ID 1231477 Fiscal Year Tax Credit Redemptions Fiscal Year Tax Credit Redemptions FY 2007 0 FY 2017 0 FY 2008 0 FY 2018 317469 FY 2009 0 FY. The Iowa Geothermal Tax Credit equals 10.

Web The highest tax credit available is 008 per pure ethanol gallon. Most local utilities offer a handsome incentive for. _____ IA 148 Tax Credits Schedule must be completed.

Geothermal Heat Pump Tax Credit. This new income tax credit replaces previous geothermal-related income tax credits that were repealed by the Iowa legislature effective. Web The Iowa Geothermal Tax Credit is.

Check Rebates Incentives. Web The Geothermal Tax Credit was available for installations beginning on or after January 1 2017 through December 31 2018. 1 2019 and is available for Iowa homeowners on Iowa residential properties.

Web Iowa provides a geothermal heat pump tax credit the 20 credit for Iowa individual income tax. The credit is available for units installed on or after Jan. Web A Geothermal Tax Credit is available for individual income taxpayers equal to 10 of qualified expenditures on a geothermal heat pump on the taxpayers residence.

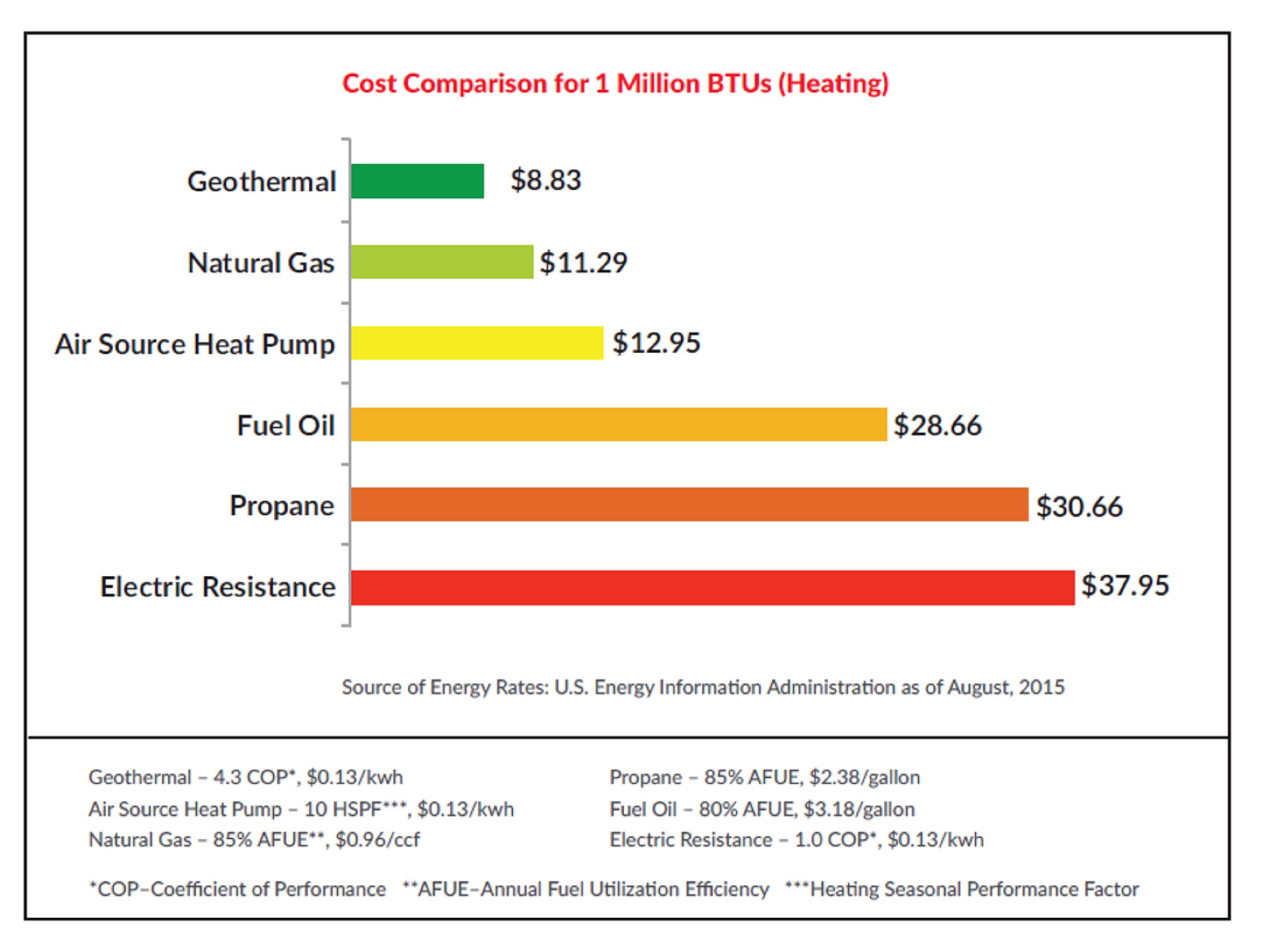

Bryan DeJong of Baxter Oil Company Baxter IA and Justin Larsen of Camblin Mechanical Inc Atlantic IAQuick FactsFederal Tax Credit. Geothermal tax credit explained Iowas geothermal heat pump tax credit mentioned in Tuesdays article about state representative candidate Curt Hanson is a residential income tax credit for up to 6 percent of the installed costs. Iowa had a short term program for geothermal and the funding was depleted in short orderOther Local Incentives.

Geothermal Incentives Iowa Geothermal Association

Iowa Energy Tax Credit Rebates Grants For Solar Wind And Geothermal Dasolar Com

Savings Calculator How Much Waterless Dx Geothermal Can Save You

Geothermal Heat Pumps Western Iowa Power Cooperative

Geothermal Investment Tax Credit Extended Through 2023

The Federal Geothermal Tax Credit Your Questions Answered

10 Benefits Of Buy A Geothermal Heat Pump Rsc Blog

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac

Federal Geothermal Tax Credits Are Back

Geothermal Tax Credits Extended Smart Choices

Geothermal Heating Cooling Northeast Iowa Mechanical

Rebates We Offer Tax Credits Incentives Savings Solon Ia

10 Benefits Of Buy A Geothermal Heat Pump Rsc Blog

Savings From Buying Geothermal

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac